Investor Education

An investor education initiative by Old Bridge Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) process. Investors should deal only with Registered Mutual Funds (RMF) details of which can be verified on the SEBI website SEBI | Recognised Intermediaries. For further information on KYC, and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Center section and contact section available on the website of Old Bridge Mutual Fund. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Investing is a long-term journey that requires a deep understanding of your personal relationship with risk. Just as each person has different financial goals, each investor has a unique tolerance for risk. Knowing where you fall on the risk spectrum can help you tailor your investment strategy to meet your financial goals while ensuring you are comfortable with the level of risk involved.

This guide introduces five distinct risk profiles— Risk-Averse, Conservative, Balanced, Growth, and Aggressive. Each is designed to help you better understand your risk tolerance.

We’ll explore how these profiles influence your investment choices, long-term strategy, and potential outcomes. Whether you are just starting out or are a seasoned investor, understanding your risk tolerance will empower you to make more confident financial decisions.

1. Risk-Averse: Safety and Preservation First

Risk-averse investors focus on the safety and preservation of their capital above all else. Their main goal is to minimize risk, even if it means accepting lower returns. The key concern for these investors is ensuring that their hard-earned money remains secure. They typically shy away from volatile investments and prefer options that offer predictable and steady returns.

A risk-averse investor prioritizes stability, often avoiding the stock market's unpredictability in favor of safer assets that protect their principal. This type of investor values the security of knowing their investments are not at risk of significant loss, even if that means missing out on potentially higher returns.

Common Investments:- Government bonds: These are considered low-risk investments backed by the government, offering a stable return over time.

- Fixed deposits: These provide a guaranteed return over a fixed period, ensuring that the investor’s principal remains secure.

- Savings accounts: While offering minimal interest, they provide easy access to cash and guaranteed safety.

Example: Vikram, a 65-year-old retiree, relies on his investments to fund his living expenses. He cannot afford to take on risky investments because his priority is to protect his principal and ensure a steady income. Vikram chooses government bonds and fixed deposits, knowing that these low-risk options will preserve his savings while providing a reliable return, even if it’s modest

Risk-averse investors typically have short to medium-term financial goals, such as funding retirement or preserving wealth for future generations. They are more concerned with protecting what they have built over time than pursuing higher returns that come with added risk. These investors prefer security over the potential for large, short-term gains, often holding investments for long periods to ensure consistent, if modest, returns.

Their portfolios are usually heavily weighted towards debt instruments and other safe assets that don’t fluctuate wildly with market movements. As a result, while their wealth may grow slowly, they are insulated from the large swings that more aggressive investors experience during market downturns.

2. Conservative: A Balanced Approach with Caution

Conservative investors seek a middle ground between safety and growth. They are open to taking on some risk but prefer to limit their exposure to significant market volatility. Their primary focus is to preserve their capital while also achieving moderate returns that outpace inflation.

Conservative investors typically prefer to build a diversified portfolio that includes a blend of low-risk assets like bonds and high-quality dividend-paying stocks. While they may allocate a portion of their portfolio to equities, they avoid speculative stocks or sectors that can be volatile. Their long-term strategy is designed to achieve steady growth without exposing themselves to too much risk.

Common Investments:- Blue-chip stocks: These are shares of established, financially sound companies with a long history of stable earnings and dividend payments.

- High-quality bonds: Bonds issued by financially secure corporations or governments that offer higher yields than savings accounts but with less risk than stocks.

- Dividend-paying stocks: Stocks that generally provide regular income in the form of dividends.

Example: Ravi, a 45-year-old father of two, is saving for his children’s education. He prefers a conservative strategy that provides growth with minimal risk. Ravi invests in a mix of blue-chip stocks, dividend-paying stocks, and high-quality bonds. This portfolio allows him to achieve slow but potential growth, ensuring that his savings grow over time without exposing his capital to significant risks.

Conservative investors are typically in the accumulation phase of their financial journey but are cautious about taking on too much risk. They have medium-term goals, such as saving for their children’s education, buying a home, or planning for early retirement. These investors understand that steady, moderate returns over time can compound into significant wealth.

Their portfolios are diversified but lean towards safer, more established investments. While they may include some growth-oriented stocks, they avoid highly speculative investments, preferring to focus on preserving their wealth while achieving modest growth. By balancing risk and reward, conservative investors manage the risk effectively while working towards long term growth.

3. Balanced: Seeking a Middle Ground

Balanced investors look for an equilibrium between risk and reward. They understand that taking on some level of risk is necessary to achieve substantial returns, but they also appreciate the importance of protecting a portion of their portfolio from market volatility. Balanced investors are willing to take moderate risks but seek to mitigate potential losses by diversifying their investments.

A balanced portfolio typically includes a mix of growth stocks, bonds, and other less risky assets like government securities. These investors aim for moderate growth, knowing that they must accept some risk in exchange for potential long term higher returns. They take a long-term view, recognizing that their portfolio will experience fluctuations, but they understand that a well-diversified portfolio has potential to grow over long term

Common Investments:- Growth stocks: These are shares in companies with potential of expansion over time, which may lead to increase in their stock value.

- Mutual funds: These pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, and other securities, spreading out risk.

- Corporate bonds: Bonds issued by companies, that typically offer better yields than government bonds but come with moderate level of risk.

Example: Nisha, a 40-year-old professional, is preparing for her retirement. She invests in a balanced portfolio that includes growth stocks in the technology sector, mutual funds, and corporate bonds. While Nisha accepts some market volatility, the stable portion of her portfolio helps cushion the impact during market downturns . She understands that this mix will help her achieve her retirement goals with diversified risks approach.

Balanced investors are typically long-term planners who want to grow their wealth but are not willing to gamble their entire portfolio on high-risk investments. They understand that diversification is key to mitigating risk while still allowing for growth. These investors typically have long-term goals, such as retirement or building a sizable nest egg, and are comfortable with moderate market volatility.

A balanced approach allows them to take advantage of growth opportunities while maintaining a safety net through diversified risk investments. Their strategy involves regularly reviewing and rebalancing their portfolio to ensure that their mix of stocks and bonds aligns with their risk tolerance and financial goals.

4. Growth: Maximizing Long-Term Potential

Growth investors are focused on maximizing the potential for long-term wealth accumulation. They are willing to take on higher levels of risk in exchange for the opportunity to achieve higher returns. These investors understand that high-reward investments often come with higher volatility, but they are willing to ride out short-term market fluctuations.

Growth investors build portfolios that are heavily weighted towards equities, particularly growth stocks in sectors with strong growth potential, such as technology, healthcare, or emerging markets. They have a long-term horizon and are willing to accept market volatility, knowing that patience will ultimately reward them with higher returns.

Common Investments:- Volatile stocks: Shares of companies in the sectors, which are known for their high growth potential but also their volatility.

- Emerging markets: Investments in developing countries that have the potential for rapid growth but come with higher political and economic risks.

- Real estate: : Investments in properties that are expected to appreciate significantly over time.

Example: Arjun, a 30-year-old tech professional, is focused on accumulating wealth for his future. He invests heavily in stocks from volatile sectors and emerging markets, understands that these sectors has potential to deliver high long-term returns with high risk. Arjun is not concerned with short-term fluctuations in the market because his primary goal is maximizing the value of his portfolio over the next several decades.

Growth investors are typically younger or have a long-term horizon, allowing them to recover from short-term market fluctuations. They are comfortable with a high degree of risk and are focused on long term capital appreciation rather than immediate income. These investors often seek out industries that are expected to grow rapidly, and are willing to endure the volatility that comes with these high-growth sectors.

Their portfolios are often concentrated in equities, with little to no exposure to bonds or other lower-risk assets. Growth investors recognize that their strategy can lead to periods of significant volatility, but they are confident that, over time, the high returns will outweigh the risks. They are patient and willing to wait for their investments to mature, understanding that long-term success requires discipline and resilience.

5. Aggressive: High-Risk, High-Reward Strategy

Aggressive investors are risk-takers by nature. They pursue high-risk, high-reward investment opportunities and are not afraid of market volatility or potential losses. Their goal is to maximize returns as quickly as possible, even if that means exposing themselves to significant risks.

Aggressive investors often focus on speculative investments, such as startups, cryptocurrencies, or emerging markets. These assets have the potential to deliver substantial returns but also come with significant risks. Aggressive investors are typically young or have a long-term horizon, allowing them to recover from any short-term losses and ride out market volatility.

Common Investments:- Cryptocurrencies: Digital currencies that are highly volatile.

- Startups: Investments in early-stage companies that are unproven but could become highly successful.

- Penny stocks: : Shares in small companies that trade at low prices, offering the potential for rapid gains but with a high level of risk.

Example: Shiv, a 25-year-old entrepreneur, is focused on rapidly growing his wealth. He invests in cryptocurrencies and startups, knowing that these investments could either skyrocket or lose significant value. With a long investment horizon and a strong risk appetite, Shiv is comfortable with short-term fluctuations as part of his long-term strategy

Aggressive investors are typically younger or have significant financial flexibility, allowing them to take on more risk. They are comfortable with the possibility of large fluctuations in their portfolio’s value and are willing to bet on high-risk, high-reward investments. These investors constantly seek out the next big opportunity to grow their wealth.

Their portfolios are concentrated in speculative investments, such as tech startups or cryptocurrencies. Aggressive investors understand that their strategy may result in significant volatility, but they are willing to accept that risk in exchange for the chance of high growth. Their focus is on maximizing returns quickly, often using a short-term mindset to capitalize on market trends and innovations.

To Conclude

Understanding your investment risk profile is the foundation for a successful financial journey. By identifying your unique risk profile, you can make smarter, more informed decisions that balance your desire for growth with your ability to handle risk. No matter where you are on your financial journey, the right strategy will help you grow your wealth in a way that aligns with your long-term objectives.

Take the time to explore your financial strengths, discover the right approach for you, and start your journey toward a prosperous future.

An Investor Education And Awareness Initiative by Old Bridge Asset Management Private Limited

Visit www.oldbridgemf.com to know about the process to complete one time Know Your Customer (KYC) requirement to invest in Mutual Funds. Investors should be cautioned to deal only with registered mutual funds, details of which can be verified on the SEBI website https://www.sebi.gov.in/intermediaries.html. For any queries, complaints & grievance redressal, investor may reach out to the AMC or Investor Relation Officer. Additionally, investors may also lodge complaints on https://scores.sebi.gov.in if they are unsatisfied with the resolutions given by the AMC. SCORE portal facilitates you to lodge your complaint online with SEBI and subsequently view it’s status. Further investors may also lodge complaint through Online Dispute Resolution Portal(‘ODR’) portal available at https://smartodr.in/login

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

રોકાણ એ એક લાંબા ગાળાની યાત્રા છે જેમાં જોખમ સાથેના તમારા વ્યક્તિગત સંબંધની ઊંડી સમજ જરૂરી છે. જેમ દરેક વ્યક્તિના નાણાકીય લક્ષ્યો અલગ-અલગ હોય છે, તે જ રીતે દરેક રોકાણકાર જોખમ પ્રત્યે એક અનોખી સહનશીલતા ધરાવતા હોય છે. જોખમ સ્પેક્ટ્રમ પર તમે ક્યાં આવો છો તે જાણવાથી તમને તમારા નાણાકીય લક્ષ્યોને પૂર્ણ કરવા માટે તમારી રોકાણ વ્યૂહરચનાને અનુરૂપ બનાવવામાં મદદ મળી શકે છે અને સાથે સાથે ખાતરી કરી શકાય છે કે તમે તેની સાથે સંકળાયેલ જોખમના સ્તર સાથે આરામદાયક છો.

આ માર્ગદર્શિકા પાંચ અલગ-અલગ જોખમ પ્રોફાઇલ્સ પ્રસ્તુત કરે છે - જોખમ-વિમુખ, રૂઢિચુસ્ત, સંતુલિત, વૃદ્ધિ અને આક્રમક. દરેક તમારી જોખમ સહનશીલતાને વધુ સારી રીતે સમજવામાં મદદ કરવા માટે રચાયેલ છે.

આપણે એ તપાસ કરીશું કે આ પ્રોફાઇલ્સ તમારી રોકાણ પસંદગીઓ, લાંબા ગાળાની વ્યૂહરચના અને સંભવિત પરિણામોને કેવી રીતે પ્રભાવિત કરે છે. ભલે તમે હમણાં જ શરૂઆત કરી રહ્યા હોવ કે પછી એક અનુભવી રોકાણકાર હોવ, તમારી જોખમ સહનશીલતાને સમજવાથી તમને વધુ આત્મવિશ્વાસપૂર્ણ નાણાકીય નિર્ણયો લેવા માટે સશક્ત બનાવવામાં આવશે.

1. જોખમ-વિમુખ: સલામતી અને સંરક્ષણ પ્રથમ

જોખમ-વિમુખ એટલે કે જોખમથી દૂર રહેનારા રોકાણકારો તેમની મૂડીની સલામતી અને જાળવણી પર સૌથી વધુ ધ્યાન કેન્દ્રિત કરે છે. તેમનો મુખ્ય ધ્યેય જોખમ ઘટાડવાનો હોય છે, ભલે તેના માટે ઓછું વળતર સ્વીકારવું પડે. આ રોકાણકારો માટે મુખ્ય ચિંતા એ છે કે તેમના મહેનતથી કમાયેલા પૈસા સુરક્ષિત રહે. તેઓ સામાન્ય રીતે અસ્થિર રોકાણોથી દૂર રહે છે અને એવા વિકલ્પો પસંદ કરે છે જે અનુમાનિત અને સ્થિર વળતર આપતા હોય.

જોખમ ટાળનાર રોકાણકાર સ્થિરતાને પ્રાથમિકતા આપે છે, ઘણીવાર શેરબજારના અણધાર્યાપણાને ટાળીને સુરક્ષિત સંપત્તિઓની તરફેણ કરે છે જે તેમની મુદ્દલનું રક્ષણ કરે છે. આ પ્રકારના રોકાણકાર એ જાણવાની સુરક્ષાને મહત્વ આપે છે કે તેમના રોકાણો નોંધપાત્ર નુકસાનના જોખમમાં નથી, પછી ભલે તેનાથી સંભવિત રીતે ઊંચા વળતર ગુમાવવા પડવાના હોય.

સામાન્ય રોકાણો:- સરકારી બોન્ડ્સ: આ રોકાણોને સરકાર દ્વારા સમર્થિત ઓછા જોખમવાળા રોકાણો ગણવામાં આવે છે, જે સમય જતાં સ્થિર વળતર આપે છે.

- ફિક્સ ડિપોઝિટ: આ નિશ્ચિત સમયગાળા દરમિયાન ગેરંટી સાથેનું વળતર પૂરું પાડે છે, જે ખાતરી આપે છે કે રોકાણકારની મુદ્દલ સુરક્ષિત રહે છે.

- બચત ખાતા: જોકે આ ન્યૂનતમ વ્યાજ ઓફર કરે છે પણ તે રોકડની સરળ પહોંચ અને સલામતીની ખાતરી આપે છે.

ઉદાહરણ: વિક્રમ કે જે ૬૫ વર્ષીય નિવૃત્ત વ્યક્તિ છે તે પોતાના જીવન ખર્ચ માટે પોતાના રોકાણો પર આધાર રાખે છે. તે જોખમી રોકાણો કરી શકતો નથી કારણ કે તેની પ્રાથમિકતા તેના મુદ્દલનું રક્ષણ કરવાની અને સ્થિર આવક સુનિશ્ચિત કરવાની છે. વિક્રમ સરકારી બોન્ડ અને ફિક્સ્ડ ડિપોઝિટ પસંદ કરે છે, કારણ કે તે જાણે છે કે આ ઓછા જોખમવાળા વિકલ્પો તેની બચતને સાચવશે અને સાથે સાથે વિશ્વસનીય વળતર પણ આપશે, ભલે તે સાધારણ હોય.

જોખમ-વિમુખ રોકાણકારો સામાન્ય રીતે ટૂંકા થી મધ્યમ ગાળાના નાણાકીય લક્ષ્યો ધરાવતા હોય છે, જેમ કે નિવૃત્તિ માટે ભંડોળ ભેગું કરવું અથવા ભાવિ પેઢીઓ માટે સંપત્તિનું રક્ષણ કરવું. તેઓ વધારાના જોખમ સાથે આવતા ઊંચા વળતરો મેળવવા કરતાં સમય જતાં તેમણે જે ભેગું કર્યું છે તેનું રક્ષણ કરવા માટે વધુ ચિંતિત હોય છે. આ રોકાણકારો મોટા, ટૂંકા ગાળાના લાભની સંભાવના કરતાં સુરક્ષાને પ્રાધાન્ય આપતા હોય છે, ઘણીવાર સતત વળતર સુનિશ્ચિત કરવા માટે લાંબા ગાળા માટે રોકાણને હોલ્ડ કરતાં હોય છે.

તેમના પોર્ટફોલિયો સામાન્ય રીતે ડેબ્ટ ઇન્સ્ટ્રુમેન્ટ્સ અને અન્ય સલામત સંપત્તિઓ પર ભારે ભાર મૂકતા હોય છે જેમાં બજારની ગતિવિધિઓ સાથે મોટા પ્રમાણમાં વધઘટ થતી નથી. પરિણામે, જ્યારે તેમની સંપત્તિ ધીમે ધીમે વધી શકે છે, તેઓ બજારના ઘટાડા દરમિયાન વધુ આક્રમક રોકાણકારો અનુભવતા મોટા ફેરફારોથી અસુરક્ષિત રહે છે.

2. રૂઢિચુસ્ત: સાવધાની સાથે સંતુલિત અભિગમ

રૂઢિચુસ્ત રોકાણકારો સલામતી અને વૃદ્ધિ વચ્ચેનો મધ્યમ માર્ગ શોધે છે. તેઓ કેટલાક જોખમ લેવા માટે ખુલ્લા હોય છે પરંતુ બજારની નોંધપાત્ર અસ્થિરતા સુધી તેમના રોકાણને મર્યાદિત રાખવાનું પસંદ કરે છે. તેમનું પ્રાથમિક ધ્યાન તેમની મૂડીનું રક્ષણ કરવાનું છે અને સાથે સાથે ફુગાવાથી આગળ વધી જાય તેવા મધ્યમ વળતર પણ પ્રાપ્ત કરવાનું છે.

રૂઢિચુસ્ત રોકાણકારો સામાન્ય રીતે વિવિધતા ધરાવતો પોર્ટફોલિયો બનાવવાનું પસંદ કરે છે જેમાં બોન્ડ્સ અને ઉચ્ચ-ગુણવત્તાયુક્ત ડિવિડન્ડ આપતા શેરો જેવી ઓછા જોખમવાળી એસેટનું મિશ્રણ હોય છે. જોકે તેઓ તેમના પોર્ટફોલિયોનો એક ભાગ ઇક્વિટીમાં ફાળવી શકે છે, સાથે જ તેઓ સટ્ટાકીય શેરો અથવા એવા ક્ષેત્રોને ટાળે છે જે અસ્થિર હોઈ શકે છે. તેમની લાંબા ગાળાની વ્યૂહરચના પોતાને વધુ પડતા જોખમમાં મૂક્યા વિના સ્થિર વૃદ્ધિ પ્રાપ્ત કરવા માટે છે.

સામાન્ય રોકાણો:- બ્લુ-ચિપ શેરો: આ સ્થાપિત, આર્થિક રીતે મજબૂત કંપનીઓના શેર છે જે સ્થિર કમાણી અને ડિવિડન્ડ ચુકવણીનો લાંબો ઇતિહાસ ધરાવતા હોય.

- ઉચ્ચ-ગુણવત્તાયુક્ત બોન્ડ્સ: નાણાકીય રીતે સુરક્ષિત કોર્પોરેશનો અથવા સરકારો દ્વારા જારી કરાયેલા બોન્ડ્સ જે બચત ખાતાઓ કરતાં વધુ રિટર્ન આપે છે પરંતુ સ્ટોક્સ કરતાં ઓછા જોખમ સાથે.

- ડિવિડન્ડ આપતા શેર: એવા શેર જે સામાન્ય રીતે ડિવિડન્ડના રૂપમાં નિયમિત આવક પ્રદાન કરે છે.

ઉદાહરણ:45 વર્ષીય રવિ, જે બે બાળકોના પિતા છે તે પોતાના બાળકોના શિક્ષણ માટે બચત કરે છે. તે એવી રૂઢિચુસ્ત વ્યૂહરચના પસંદ કરે છે જે ઓછામાં ઓછા જોખમ સાથે વૃદ્ધિ પૂરી પાડે છે. રવિ બ્લુ-ચિપ શેરો, ડિવિડન્ડ ચૂકવતા શેરો અને ઉચ્ચ-ગુણવત્તાયુક્ત બોન્ડ્સના મિશ્રણમાં રોકાણ કરે છે. આ પોર્ટફોલિયો તેને ધીમી પરંતુ સંભવિત વૃદ્ધિ પ્રાપ્ત કરવાની મંજૂરી આપે છે, જેથી ખાતરી કરી શકાય કે તેની બચત સમય જતાં વધે છે અને તેની મૂડી ખાસ જોખમમાં ન મૂકાય.

રૂઢિચુસ્ત રોકાણકારો સામાન્ય રીતે તેમની નાણાકીય યાત્રાના સંચય તબક્કામાં હોય છે પરંતુ તેઓ વધુ પડતું જોખમ લેવા અંગે સાવધ રહે છે. તેઓ મધ્યમ-ગાળાના લક્ષ્યો ધરાવતા હોય છે, જેમ કે તેમના બાળકોના શિક્ષણ માટે બચત કરવી, ઘર ખરીદવું અથવા વહેલા નિવૃત્તિ માટે આયોજન કરવું. આ રોકાણકારો સમજે છે કે સમય જતાં સ્થિર, મધ્યમ વળતર નોંધપાત્ર સંપત્તિમાં પરિણમી શકે છે.

તેમના પોર્ટફોલિયો વિવિધતા ધરાવતા હોય છે પરંતુ વધુ સુરક્ષિત, વધુ સ્થાપિત રોકાણો તરફ ઝુકાવ ધરાવે છે. જ્યારે તેમાં કેટલાક વૃદ્ધિલક્ષી શેરોનો સમાવેશ થઈ શકે છે, તેઓ વધુ પડતાં સટ્ટાકીય રોકાણોને ટાળે છે, સાધારણ વૃદ્ધિ પ્રાપ્ત કરતી વખતે તેમની સંપત્તિને સાચવવા પર ધ્યાન કેન્દ્રિત કરવાનું પસંદ કરે છે. જોખમ અને પુરસ્કારને સંતુલિત કરીને, રૂઢિચુસ્ત રોકાણકારો લાંબા ગાળાના વિકાસ તરફ કામ કરીને જોખમનું અસરકારક રીતે સંચાલન કરે છે.

3. સંતુલિત: વચ્ચેનો માર્ગ પસંદ કરવો

સંતુલિત રોકાણકારો જોખમ અને પુરસ્કાર વચ્ચે સંતુલન શોધતા હોય છે. તેઓ સમજે છે કે સારું એવું વળતર મેળવવા માટે અમુક સ્તરનું જોખમ લેવું જરૂરી છે, પરંતુ તેઓ તેમના પોર્ટફોલિયોના એક ભાગને બજારની અસ્થિરતાથી બચાવવાના મહત્વને પણ સમજે છે. સંતુલિત રોકાણકારો મધ્યમ જોખમો લેવા તૈયાર હોય છે પરંતુ તેમના રોકાણોમાં વૈવિધ્યીકરણ કરીને સંભવિત નુકસાન ઘટાડવાનો પ્રયાસ કરે છે.

સંતુલિત પોર્ટફોલિયોમાં સામાન્ય રીતે ગ્રોથ સ્ટોક્સ, બોન્ડ્સ અને સરકારી સિક્યોરિટીઝ જેવી ઓછી જોખમી એસેટનું સંયોજન હોય છે. આ રોકાણકારો મધ્યમ વૃદ્ધિનું લક્ષ્ય ધરાવતા હોય છે, તેઓ જાણે છે કે સંભવિત લાંબા ગાળાના ઊંચા વળતરના બદલામાં તેમને થોડું જોખમ સ્વીકારવું પડશે. તેઓ લાંબા ગાળાનો દૃષ્ટિકોણ અપનાવે છે, તે માનીને કે તેમના પોર્ટફોલિયોમાં વધઘટ થશે, પરંતુ તેઓ સમજે છે કે સારી રીતે વૈવિધ્યસભર પોર્ટફોલિયો લાંબા ગાળામાં વૃદ્ધિ થવાની સંભાવના ધરાવતા હોય છે.

સામાન્ય રોકાણો:- ગ્રોથ સ્ટોક્સ: આ એવી કંપનીઓના શેર છે જેમના સમય જતાં વિસ્તરણની સંભાવના હોય છે, જે તેમના શેર મૂલ્યમાં વધારો કરી શકે છે.

- મ્યુચ્યુઅલ ફંડ્સ: આ ફંડ્સ બહુવિધ રોકાણકારો પાસેથી નાણાં એકઠા કરીને સ્ટોક્સ, બોન્ડ્સ અને અન્ય સિક્યોરિટીઝના વૈવિધ્યસભર પોર્ટફોલિયોમાં રોકાણ કરે છે, જે જોખમને વિવિધ રીતે ફેલાવે છે.

- કોર્પોરેટ બોન્ડ્સ: કંપનીઓ દ્વારા જારી કરાયેલા બોન્ડ્સ, જે સામાન્ય રીતે સરકારી બોન્ડ્સ કરતાં વધુ સારું વળતર આપે છે પરંતુ મધ્યમ સ્તરનું જોખમ ધરાવે છે.

ઉદાહરણ:એક 40 વર્ષીય વ્યાવસાયિક નિશા, પોતાની નિવૃત્તિની તૈયારી કરી રહી છે. તે એક સંતુલિત પોર્ટફોલિયોમાં રોકાણ કરે છે જેમાં ટેકનોલોજી ક્ષેત્ર, મ્યુચ્યુઅલ ફંડ્સ અને કોર્પોરેટ બોન્ડ્સમાં વૃદ્ધિ શેરોનો સમાવેશ થાય છે. જ્યારે નિશા બજારની કેટલીક અસ્થિરતાને સ્વીકારે છે, ત્યારે તેના પોર્ટફોલિયોનો સ્થિર ભાગ બજારના મંદી દરમિયાન અસરને ઘટાડવામાં મદદ કરે છે. તેણી સમજે છે કે આ સંયોજન તેને વૈવિધ્યસભર જોખમ અભિગમ સાથે તેના નિવૃત્તિ લક્ષ્યોને પ્રાપ્ત કરવામાં મદદ કરશે.

સંતુલિત રોકાણકારો સામાન્ય રીતે લાંબા ગાળાના આયોજક હોય છે જેઓ તેમની સંપત્તિ તો વધારવા માંગે છે પરંતુ ઉચ્ચ જોખમવાળા રોકાણો પર તેમના સમગ્ર પોર્ટફોલિયો સાથે જુગાર રમવા તૈયાર નથી. તેઓ સમજે છે કે વૃદ્ધિ કરવી હોય તો જોખમ ઘટાડવા માટે વૈવિધ્યકરણ કરવું મહત્વનું છે. આ રોકાણકારો સામાન્ય રીતે નિવૃત્તિ અથવા મોટા પાયે રોકાણ કરવા જેવા લાંબા ગાળાના લક્ષ્યો ધરાવતા હોય છે, અને બજારની મધ્યમ અસ્થિરતાને સ્વીકારી શકે છે.

સંતુલિત અભિગમ તેમને વૈવિધ્યસભર જોખમ રોકાણો દ્વારા એક સેફ્ટી નેટ જાળવી રાખીને વૃદ્ધિની તકોનો લાભ લેવા દે છે. તેમની વ્યૂહરચનામાં નિયમિતપણે તેમના પોર્ટફોલિયોની સમીક્ષા અને પુનઃસંતુલનનો સમાવેશ થાય છે જેથી ખાતરી કરી શકાય કે તેમના શેર અને બોન્ડનું સંયોજન તેમની જોખમ સહનશીલતા અને નાણાકીય લક્ષ્યો સાથે સુસંગત છે.

4. ગ્રોથ: લાંબા ગાળાની સંભાવનાને મહત્તમ બનાવવી

ગ્રોથ એટલે કે વૃદ્ધિ પ્રકારના રોકાણકારો લાંબા ગાળાની સંપત્તિ સંચયની સંભાવનાને મહત્તમ કરવા પર ધ્યાન કેન્દ્રિત કરે છે. તેઓ ઊંચા વળતર મેળવવાની તકના બદલામાં ઊંચા સ્તરનું જોખમ લેવા તૈયાર હોય છે. આ રોકાણકારો સમજે છે કે ઉચ્ચ-પુરસ્કાર આપતા રોકાણો સાથે ઘણીવાર ઊંચી અસ્થિરતા જોડાયેલ હોય છે, પરંતુ તેઓ ટૂંકા ગાળાની બજારની વધઘટનો સામનો કરવા તૈયાર હોય છે.

ગ્રોથ રોકાણકારો એવા પોર્ટફોલિયો બનાવે છે જે ઇક્વિટી પર વધુ ભાર મૂકે છે, ખાસ કરીને ટેક્નોલોજી, હેલ્થકેર અથવા ઉભરતા બજારો જેવા મજબૂત વૃદ્ધિની સંભાવના ધરાવતા ક્ષેત્રોમાં ગ્રોથ સ્ટોક્સ. તેઓ લાંબા ગાળાની મર્યાદા ધરાવે છે અને તેઓ બજારની અસ્થિરતાને સ્વીકારવા પણ તૈયાર હોય છે, કારણ કે તેઓ જાણે છે કે ધીરજ તેમને આખરે ઉચ્ચ વળતર આપશે.

સામાન્ય રોકાણો:- વોલેટાઇલ સ્ટોક્સ એટલે કે અસ્થિરતા ધરાવતા શેર: ઉચ્ચ વૃદ્ધિ ક્ષમતા માટે જાણીતા ક્ષેત્રોની કંપનીઓના શેર, પરંતુ તેમની અસ્થિરતા પણ.

- ઉભરતા બજારો: વિકાસશીલ દેશોમાં રોકાણ જેમાં ઝડપી વિકાસની સંભાવના છે પરંતુ તે ઉચ્ચ રાજકીય અને આર્થિક જોખમો ધરાવતા હોય છે.

- રિયલ એસ્ટેટ: : એવી મિલકતોમાં રોકાણ જેમાં સમય જતાં નોંધપાત્ર રીતે વધવાની અપેક્ષા હોય.

ઉદાહરણ: 30 વર્ષીય ટેક પ્રોફેશનલ અર્જુનનું ફોકસ પોતાના ભવિષ્ય માટે સંપત્તિ એકઠી કરવા પર છે. તે અસ્થિર ક્ષેત્રો અને ઉભરતા બજારોના શેરોમાં મોટું રોકાણ કરે છે, તે સમજે છે કે આ ક્ષેત્રોમાં ઊંચા જોખમ સાથે લાંબા ગાળાના ઊંચા વળતર આપવાની ક્ષમતા છે. અર્જુનને બજારમાં ટૂંકા ગાળાના વધઘટની ચિંતા નથી કારણ કે તેનો પ્રાથમિક ધ્યેય આગામી કેટલાક દાયકાઓમાં તેના પોર્ટફોલિયોના મૂલ્યને મહત્તમ બનાવવાનો છે.

વૃદ્ધિ પ્રકારના રોકાણકારો સામાન્ય રીતે યુવાન હોય છે અથવા લાંબા ગાળાની સમયમર્યાદા ધરાવતા હોય છે, જે તેમને ટૂંકા ગાળાની બજારની વધઘટમાંથી બહાર આવવાની મંજૂરી આપે છે. તેઓને ઉચ્ચ સ્તરના જોખમ સાથે કોઈ પરેશાની નથી હોતી અને તાત્કાલિક આવકને બદલે લાંબા ગાળાના મૂડી મૂલ્યવૃદ્ધિ પર ધ્યાન કેન્દ્રિત કરતા હોય છે. આ રોકાણકારો ઘણીવાર એવા ઉદ્યોગો શોધતા હોય છે જે ઝડપથી વૃદ્ધિ પામે તેવી અપેક્ષા રાખે છે, અને આ ઉચ્ચ-વૃદ્ધિ ક્ષેત્રો સાથે આવતી અસ્થિરતાને સહન કરવા તૈયાર હોય છે.

તેમના પોર્ટફોલિયો ઘણીવાર ઇક્વિટીમાં કેન્દ્રિત હોય છે, જે બોન્ડ્સ અથવા અન્ય ઓછા જોખમવાળી સંપત્તિઓમાં ખૂબ જ ઓછું અથવા શૂન્ય એક્સપોઝર ધરાવતા હોય છે. વૃદ્ધિ રોકાણકારો જાણે છે કે તેમની વ્યૂહરચના નોંધપાત્ર અસ્થિરતા અવધિ તરફ દોરી શકે છે, પરંતુ તેમને વિશ્વાસ છે કે, સમય જતાં, જોખમો કરતાં ઊંચા વળતરનું પલ્લું વધી જશે. તેઓ ધીરજવાન હોય છે અને તેમના રોકાણો પરિપક્વ થાય ત્યાં સુધી રાહ જોવા તૈયાર હોય છે, તેઓ સમજે છે કે લાંબા ગાળાની સફળતા માટે શિસ્ત અને સ્થિતિસ્થાપકતાની જરૂર છે.

5. આક્રમક: ઉચ્ચ જોખમ, વધુ પુરસ્કારની વ્યૂહરચના

આક્રમક રોકાણકારો સ્વભાવે જોખમ લેનારા હોય છે. તેઓ ઉચ્ચ જોખમ, વધુ પુરસ્કાર પ્રકારની રોકાણ તકો શોધે છે અને બજારની અસ્થિરતા કે સંભવિત નુકસાનથી ડરતા નથી. તેમનો ધ્યેય શક્ય તેટલી ઝડપથી મહત્તમ વળતર મેળવવાનો છે, ભલે તેના કારણે પોતાને નોંધપાત્ર જોખમમાં મુકવા પડે.

આક્રમક રોકાણકારો ઘણીવાર સટ્ટાકીય રોકાણો પર ફોકસ કરતાં હોય છે, જેમ કે સ્ટાર્ટઅપ્સ, ક્રિપ્ટોકરન્સી અથવા ઉભરતા બજારો. આ સંપત્તિઓમાં નોંધપાત્ર વળતર આપવાની ક્ષમતા હોય છે પરંતુ તેમાં નોંધપાત્ર જોખમો પણ હોય છે. આક્રમક રોકાણકારો સામાન્ય રીતે યુવાન હોય છે અથવા લાંબા ગાળાની અવધિ ધરાવતા હોય છે, જે તેમને કોઈપણ ટૂંકા ગાળાના નુકસાનમાંથી બહાર નીકળવા અને બજારની અસ્થિરતાને દૂર કરવાનો અવસર આપે છે.

સામાન્ય રોકાણો:- ક્રિપ્ટોકરન્સી: એક પ્રકારની ડિજિટલ કરન્સી જે ખૂબ જ અસ્થિર હોય છે.

- સ્ટાર્ટઅપ્સ: પ્રારંભિક તબક્કાની કંપનીઓમાં રોકાણ જે સાબિત થયેલ નથી પરંતુ ખૂબ જ સફળ થઈ શકે છે.

- પેની સ્ટોક્સ: નાની કંપનીઓમાં શેર જેમાં નીચા ભાવે ટ્રેડ થતાં હોય છે, ઝડપી લાભની સંભાવના આપે છે પરંતુ ઉચ્ચ સ્તરનું જોખમ ધરાવે છે.

ઉદાહરણ: 25 વર્ષીય ઉદ્યોગસાહસિક શિવનું ધ્યાન પોતાની સંપત્તિને ઝડપથી વધારવા પર કેન્દ્રિત છે. તે ક્રિપ્ટોકરન્સી અને સ્ટાર્ટઅપ્સમાં રોકાણ કરે છે, તે જાણીને કે આ રોકાણો ક્યાં તો આસમાને પહોંચી શકે છે અથવા નોંધપાત્ર મૂલ્ય ગુમાવી શકે છે. લાંબી રોકાણ અવધિ અને મજબૂત જોખમ લેવાની ક્ષમતા સાથે, શિવ પોતાની લાંબા ગાળાની વ્યૂહરચનાના ભાગ રૂપે ટૂંકા ગાળાની વધઘટનો સામનો કરવા માટે તૈયાર છે.

આક્રમક રોકાણકારો સામાન્ય રીતે યુવાન હોય છે અથવા તેઓ નોંધપાત્ર નાણાકીય સુગમતા ધરાવતા હોય છે, જે તેમને વધુ જોખમ લેવાની મંજૂરી આપે છે. તેઓ તેમના પોર્ટફોલિયોના મૂલ્યમાં મોટા વધઘટની શક્યતાને સ્વીકારતા હોય છે અને ઉચ્ચ-જોખમ, વધુ પુરસ્કાર રોકાણો પર દાવ લગાવવા તૈયાર હોય છે. આ રોકાણકારો સતત તેમની સંપત્તિ વધારવા માટે આવનારી મોટી તકોની શોધમાં હોય છે.

તેમના પોર્ટફોલિયો ટેક સ્ટાર્ટઅપ્સ અથવા ક્રિપ્ટોકરન્સી જેવા સટ્ટાકીય રોકાણોમાં કેન્દ્રિત હોય છે. આક્રમક રોકાણકારો સમજે છે કે તેમની વ્યૂહરચના નોંધપાત્ર અસ્થિરતામાં પરિણમી શકે છે, પરંતુ તેઓ ઉચ્ચ વૃદ્ધિની તકના બદલામાં તે જોખમ સ્વીકારવા તૈયાર હોય છે. તેમનું ધ્યાન ઝડપથી મહત્તમ વળતર મેળવવા પર હોય છે, જે ઘણીવાર બજારના વલણો અને નવીનતાઓનો લાભ લેવા માટે ટૂંકા ગાળાની માનસિકતાનો ઉપયોગ કરે છે.

નિષ્કર્ષ

સફળ નાણાકીય સફરનો પાયો છે તમારી રોકાણ જોખમ પ્રોફાઇલને સમજવી. તમારા માટે અનન્ય જોખમ પ્રોફાઇલને ઓળખીને, તમે વધુ સ્માર્ટ, વધુ જાણકાર નિર્ણયો લઈ શકો છો જે તમારી વૃદ્ધિની ઇચ્છાને જોખમને સંભાળવાની ક્ષમતા સાથે સંતુલિત કરે છે. તમે તમારી નાણાકીય સફરમાં ગમે ત્યાં હોવ, યોગ્ય વ્યૂહરચના તમને તમારી સંપત્તિને તમારા લાંબા ગાળાના ઉદ્દેશ્યો સાથે સુસંગત રીતે વધારવામાં મદદ કરશે.

તમારી નાણાકીય શક્તિઓનું અન્વેષણ કરવા માટે સમય કાઢો, તમારા માટે યોગ્ય અભિગમ શોધો અને સમૃદ્ધ ભવિષ્ય તરફ તમારી યાત્રા શરૂ કરો.

ઓલ્ડ બ્રિજ એસેટ મેનેજમેન્ટ પ્રાઇવેટ લિમિટેડ દ્વારા રોકાણકાર શિક્ષણ અને જાગૃતિ પહેલ

મ્યુચ્યુઅલ ફંડમાં રોકાણ કરવા માટે એક વખત "તમારા ગ્રાહકને જાણો" (KYC) ની જરૂરિયાત પૂર્ણ કરવાની પ્રક્રિયા વિશે જાણવા માટે www.oldbridgemf.com ની મુલાકાત લો. રોકાણકારોને ફક્ત રજિસ્ટર્ડ મ્યુચ્યુઅલ ફંડ સાથે જ વ્યવહાર કરવાની ચેતવણી આપવી જોઈએ, જેની વિગતો SEBI વેબસાઇટ https://www.sebi.gov.in/intermediaries.html પર ચકાસી શકાય છે. કોઈપણ પ્રશ્નો, ફરિયાદો અને ફરિયાદ નિવારણ માટે, રોકાણકાર AMC અથવા રોકાણકાર સંબંધ અધિકારીનો સંપર્ક કરી શકે છે. વધુમાં, જો રોકાણકારો AMC દ્વારા આપવામાં આવેલા ઠરાવોથી અસંતુષ્ટ હોય તો તેઓ https://scores.sebi.gov.in પર પણ ફરિયાદ નોંધાવી શકે છે. SCORE પોર્ટલ તમને SEBI માં તમારી ફરિયાદ ઓનલાઈન નોંધાવવા અને ત્યારબાદ તેની સ્થિતિ જોવાની સુવિધા આપે છે. વધુમાં, રોકાણકારો https://smartodr.in/login પર ઉપલબ્ધ ઓનલાઈન વિવાદ નિવારણ પોર્ટલ (‘ODR’) પોર્ટલ દ્વારા પણ ફરિયાદ નોંધાવી શકે છે.

મ્યુચ્યુઅલ ફંડ રોકાણો બજારના જોખમોને આધીન છે, યોજના સંબંધિત બધા દસ્તાવેજો કાળજીપૂર્વક વાંચો.

In investing, numbers speak but emotions often scream louder.

Even seasoned investors, with years of market experience, can fall prey to emotional decisions. Whether it's the rush of a bull market or the panic of a downturn, emotions like fear, greed, and overconfidence often override logic. These reactions, known as emotional investing triggers, can silently erode long-term wealth

So, what exactly are these triggers? And how can investors stay in control?

What Are Emotional Investing Triggers?

Simply put, they are psychological patterns that influence how we behave with our money. They cause us to act not based on strategy or research, but on instinct and emotion, often at the worst possible moments.

1. FOMO (Fear of Missing Out)

This is perhaps the most common trigger. When markets are rallying or everyone’s talking about the “next big thing,” investors feel the urge to jump in even if they’ve missed the initial wave.

What it sounds like:"Everyone’s making money from this stock. I should get in now before it's too late."

The problem:Buying late in a trend usually means buying at inflated prices. This often leads to poor entry points and regret during corrections.

2. Overconfidence

A few successful decisions can convince investors they can time the market or outguess it.

What it sounds like:"I knew that stock would double. I’ve got a good instinct for this."

The problem:Overconfidence can lead to excessive risk-taking or ignoring fundamentals. It creates a false sense of control in a market that’s anything but predictable.

3. Loss Aversion

Research shows that people feel the pain of a loss twice as strongly as the joy of a gain. This often leads investors to sell too early, or not invest at all.

What it sounds like:"What if the market falls again? I’d rather stay in cash."

The problem:Loss aversion leads to missing out on long-term opportunities because of short-term fear.

4. Confirmation Bias

Investors often seek out information that supports their beliefs and ignore anything that contradicts them.

What it sounds like:"This expert agrees with my view. I’ll stick to my plan."

The problem:By ignoring alternate viewpoints, investors limit their perspective and often stay invested in underperforming assets.

5. Regret Aversion

The fear of making a mistake can paralyze decision-making altogether.

What it sounds like:"What if I invest now and it crashes tomorrow?"

The problem:This trigger leads to inaction, often during the best windows to invest.

How Emotional Triggers Impact Your Wealth

- Emotional investing often means buying high and selling low, the opposite of what successful investing requires.

- Short-term reactions can derail long-term goals.

- Emotions magnify market noise, leading to stress, overtrading, and poor judgment.

How to Stay Rational in an Emotional Market

The good news? You don’t need to shut off your emotions. You just need to understand and manage them.

Here are some ways to bring discipline back into investing:

- Stick to a long-term plan Set clear financial goals and allocate assets accordingly. Don’t shift your strategy based on market mood swings

- Invest through systemsUse SIPs or professional strategies that reduce the temptation to time the market.

- Track data, not dramaTune out the noise and focus on business fundamentals, valuations, and long-term trends.

- Get expert guidance Partner with managers who follow structured, research-backed investment philosophies.

Successful investing isn’t just about finding the right stocks, it’s about following the right mindset.

The approach should be rooted in discipline, not emotion. One should avoid market fads, stay committed to fundamentals, and build portfolios with long-term conviction. Because in the end, the best investors aren’t the most emotional, they’re the most aware.

Pro Tip:

Markets may run on sentiment, but investors are built for logic. Recognizing these feelings early isn’t a flaw—it’s a form of strength. It’s your first real edge in building a sharper, more resilient portfolio.

Disclaimer:

The information is for general purposes only and not an investment advice. Readers should seek professional advice before taking any investment related decisions. The document has been prepared on the basis of publicly available data/ information, internally developed data and other sources believed to be reliable.

“An investor education initiative by Old Bridge Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) process. Investors should deal only with Registered Mutual Funds (RMF) details of which can be verified on the SEBI website SEBI|Recognised Intermediaries. For further information on KYC, and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section and contact section available on the website of Old Bridge Mutual Fund.”

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

Investing in the stock market can often feel overwhelming with countless companies and mutual fundto choose from. For those looking to prioritize long-term growth while maintaining a focused approach, Focused Funds can offer a strategic advantage. Let’s explore why these funds matter and how they can add value to your portfolio.

1. Concentration on High-Quality Companies

Focused Funds invest in a select number of stocks, typically around 30 companies. This concentrated approach allows fund managers to focus on high-potential businesses, instead of spreading investments too thin. By handpicking the most promising companies, these funds aim for long-term returns.

- Why it matters: With fewer companies in the portfolio, fund managers can dedicate more attention and resources to understanding each business deeply, ensuring they select those with solid growth potential.

2. Alignment with Market Leaders

These funds often focus on industry leaders or companies on the path to becoming dominant players. These businesses typically have strong fundamentals, efficient use of capital, and minimal debt. By backing these leaders, investors can benefit from their long-term growth.

- Why it matters: Market leaders tend to handle economic downturns better and emerge stronger, providing both stability and growth opportunities for investors.

3. Avoiding Over-Diversification

While diversification is important for managing risk, having too many stocks can reduce the effectiveness of your investment strategy. Focused Funds strike a balance by providing enough diversification to manage risk but remain concentrated enough for strategic investment exposure.

- Why it matters: You get the benefits of diversification while retaining the strategic focus on potential long term performance that can come with a focused portfolio.

4. Opportunities in Emerging Sectors

These funds often target growing sectors, such as technology, healthcare, or renewable energy. By focusing on companies in these industries, investors can potentially benefit from long-term trends that has potential to outperform more traditional sectors.

- Why it matters: Investors gain access to high-growth industries, with strong potentials for long term value appreciation.

5. Disciplined Buy-and-Hold Strategy

Focused Funds usually adopt a buy-and-hold strategy, aiming for long-term wealth creation rather than short-term gains. This disciplined approach helps investors navigate market volatility while benefiting from the growth of selected companies.

- Why it matters: Patience pays off. By staying committed to a well-researched selection of companies, investors can watch their investments grow over time.

Conclusion: A Strategic Choice for Long-Term Growth

Focused Funds offer a targeted approach to investing aiming to build long-term value by investing in select, well-researched performing companies.. By limiting the number of stocks in the portfolio, these funds offer focused exposure to high-quality businesses, without the drawbacks of over-diversification. For investors aiming for long-term capital appreciation, Focused Funds can be a valuable tool.

An Investor Education And Awareness Initiative by Old Bridge Asset Management Private Limited

Visit www.oldbridgemf.com to know about the process to complete one time Know Your Customer (KYC) requirement to invest in Mutual Funds. Investors should be cautioned to deal only with registered mutual funds, details of which can be verified on the SEBI website https://www.sebi.gov.in/intermediaries.html. For any queries, complaints & grievance redressal, investor may reach out to the AMC or Investor Relation Officer. Additionally investors may also lodge complaints on https://scores.sebi.gov.in if they are unsatisfied with the resolutions given by the AMC. SCORE portal facilitates you to lodge your complaint online with SEBI and subsequently view it’s status. Further investors may also lodge complaint through Online Dispute Resolution Portal(‘ODR’) portal available at https://smartodr.in/login

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

शेअर बाजारात गुंतवणूक करणे अनेकदा असंख्य कंपन्या आणि म्युच्युअल फंड्सच्या पर्यायांमुळे गोंधळात टाकणारे वाटू शकते. ज्यांना दीर्घकालीन वाढीला प्राधान्य देताना केंद्रित दृष्टिकोन ठेवायचा आहे, त्यांच्यासाठी फोकस्ड फंड्स धोरणात्मक लाभ देऊ शकतात. चला, हे फंड्स का महत्त्वाचे आहेत आणि ते आपल्या पोर्टफोलिओमध्ये कसे मूल्यवर्धन करू शकतात हे जाणून घेऊया.

1. उच्च-गुणवत्तेच्या कंपन्यांवर लक्ष केंद्रित

फोकस्ड फंड्स निवडक स्टॉक्समध्ये, साधारणपणे 30 कंपन्यांमध्ये गुंतवणूक करतात. ही केंद्रित पद्धत फंड व्यवस्थापकांना संभाव्य व्यवसायांवर लक्ष केंद्रित करण्यास सक्षम करते, जेणेकरून गुंतवणूकीचा फापटपसारा टाळता येतो. सर्वाधिक आशाजनक कंपन्यांची निवड करून, हे फंड्स दीर्घकालीन परताव्यावर लक्ष केंद्रित करतात.

- हे का महत्त्वाचे आहे: पोर्टफोलिओमध्ये कमी कंपन्या असल्याने, फंड व्यवस्थापक प्रत्येक व्यवसायाचे सखोल विश्लेषण करण्यासाठी अधिक लक्ष आणि भर देऊन वाढीची मजबूत क्षमता असलेल्या कंपन्यांची निवड करू शकतात.

2. बाजारातील आघाडीच्या कंपन्यांशी सुसंगतता

हे फंड्स अनेकदा उद्योगातील अग्रगण्य किंवा भविष्यात आघाडी घेणाऱ्या कंपन्यांमध्ये गुंतवणूक करतात. या कंपन्या सहसा मजबूत मूलतत्त्वे, कार्यक्षम भांडवल वापर आणि कमी कर्ज यांसारख्या बाबींमध्ये प्रबळ असतात. या अग्रगण्य कंपन्यांमध्ये गुंतवणूक करून, गुंतवणूकदार त्यांच्या दीर्घकालीन वाढीचा लाभ घेऊ शकतात.

- हे का महत्त्वाचे आहे: अशा अग्रगण्य कंपन्या सहसा आर्थिक मंदीचे चांगल्या प्रकारे व्यवस्थापन करतात आणि पुन्हा सक्षमपणे उभ्या राहतात, गुंतवणूकदारांना स्थिरता आणि वाढ दोन्ही मिळवून देतात.

3. अत्याधिक विविधीकरण टाळणे

जोखीम व्यवस्थापनासाठी विविधीकरण महत्त्वाचे असले तरी, खूप जास्त स्टॉक्स असणे तुमच्या गुंतवणुक धोरणाची प्रभावीता कमी करू शकते. फोकस्ड फंड्स जोमखींवर नियंत्रण मिळवण्यासाठी पुरेशी विविधता राखून संतुलन साधतात, तसेच धोरणात्मक गुंतवणुकीवरही पुरेसे लक्ष केंद्रित करतात.

- हे का महत्त्वाचे आहे: तुम्हाला विविधीकरणाचे फायदे मिळतात आणि दीर्घकालीन कामगिरीवर लक्ष केंद्रित केलेले पोर्टफोलिओही राखले जाते.

4. उदयोन्मुख क्षेत्रांमधील संधी

हे फंड्स अनेकदा तंत्रज्ञान, आरोग्यसेवा किंवा अक्षय ऊर्जा यांसारख्या विकसित होणाऱ्या क्षेत्रांमध्ये गुंतवणूक करतात. या उद्योगांमधील कंपन्यांवर लक्ष केंद्रित करून, गुंतवणूकदार दीर्घकालीन ट्रेंड्सचा फायदा घेऊन पारंपरिक क्षेत्रांपेक्षा जास्त वाढीचा लाभ मिळवू शकतात.

- हे का महत्त्वाचे आहे: गुंतवणूकदारांना उच्च वाढीची क्षमता असलेल्या उद्योगांमध्ये प्रवेश मिळतो, जे सक्षमपणे दीर्घकालीन मूल्यनिर्मिती करू शकतात.

5. शिस्तबद्ध "बाय अँड होल्ड" धोरण

फोकस्ड फंड्स सामान्यतः अल्पकालीन नफ्याऐवजी दीर्घकालीन संपत्ती निर्मितीच्या उद्देशाने 'बाय अँड होल्ड' पद्धती अवलंबतात. या शिस्तबद्ध पद्धतीमुळे गुंतवणूकदारांना बाजारातील चढ-उतारावर मार्ग काढण्यास मदत होते, त्याचबरोबर निवडक कंपन्यांच्या वाढीचा लाभ घेता येतो.

- हे का महत्त्वाचे आहे: सहसा संयम दीर्घकालीन लाभदायक ठरतो. संशोधन आधारित कंपन्यांमध्ये सातत्याने गुंतवणूक ठेवल्यास, गुंतवणूकदारांना त्यांच्या गुंतवणुकीत वाढ होताना मदत होते.

निष्कर्ष: दीर्घकालीन वाढीसाठी धोरणात्मक निवड

फोकस्ड फंड्स हे निवडक आणि संशोधन-आधारित कंपन्यांमध्ये गुंतवणूक करून दीर्घकालीन मूल्यनिर्मितीसाठी केंद्रित पद्धत वापरतात. कमी कंपन्यांमध्ये गुंतवणूक करून हे फंड्स उच्च-गुणवत्तेच्या व्यवसायांमध्ये लक्ष केंद्रित करतात, ज्यामुळे अति-विविधीकरणाचे तोटे टाळले जातात. दीर्घकालीन भांडवली वृद्धीचे लक्ष्य ठेवणाऱ्या गुंतवणूकदारांसाठी फोकस्ड फंड्स हे उपयुक्त साधन ठरू शकतात.

ओल्ड ब्रिज अॅसेट मॅनेजमेंट प्रायव्हेट लिमिटेडतर्फे गुंतवणूकदारांसाठी शिक्षण व जागरूकता उपक्रम

म्युच्युअल फंडमध्ये गुंतवणूक करण्यासाठी “नो युअर कस्टमर” (केवायसी) ही एकदाच पूर्ण करावी लागणारी प्रक्रिया कशी पूर्ण करावी, याबाबत अधिक जाणून घेण्यासाठी www.oldbridgemf.com या संकेतस्थळाला भेट द्या. गुंतवणूकदारांनी केवळ नोंदणीकृत म्युच्युअल फंडांशी व्यवहार करावा, याबाबत सतर्क राहावे. अशा फंडांची माहिती सेबीच्या संकेतस्थळावर https://www.sebi.gov.in/intermediaries.html येथे पाहता येते. कोणत्याही शंका, तक्रारी किंवा तक्रार निवारणासाठी गुंतवणूकदारांनी एएमसी किंवा गुंतवणूकदार संबंध अधिकारी यांच्याशी संपर्क साधावा. जर एएमसी कडून समाधानकारक उत्तर मिळाले नाही तर गुंतवणूकदार https://scores.sebi.gov.in या SCORE पोर्टलवर तक्रार नोंदवू शकतात. या पोर्टलच्या मदतीने तक्रार ऑनलाईन दाखल करून त्याची स्थिती पाहण्याची सुविधा प्राप्त होते. तसेच, गुंतवणूकदार https://smartodr.in/login या ऑनलाईन विवाद निराकरण ‘ओडीआर’ पोर्टलद्वारेही तक्रार नोंदवू शकतात.

म्युच्युअल फंड गुंतवणूक ही बाजारातील जोखमीच्या अधीन आहे. योजनेसंबंधीत सर्व दस्तऐवज काळजीपूर्वक वाचा.

Same Product. Two Prices. One Opportunity

Ever booked a flight only to find the same seat cheaper on another website? That price difference is exactly what smart travellers take advantage of. Arbitrage Funds work on a similar idea, only in financial markets.

They don’t rely on predicting trends or chasing returns. Instead, they focus on the price gap between the cash market and the futures market for the same stock, and use that gap to generate steady returns.

How It Works

Let’s say a company’s stock is trading at ₹100 in the cash market and ₹102 in the futures market.

- The fund buys the stock in the cash market at ₹100

- It simultaneously agrees to sell the same stock in the futures market at ₹102

- When the trade settles, the ₹2 gap becomes the fund’s return

The fund does not wait for the stock price to go up or down. It simply captures the price difference and locks in the return when both trades align at expiry.

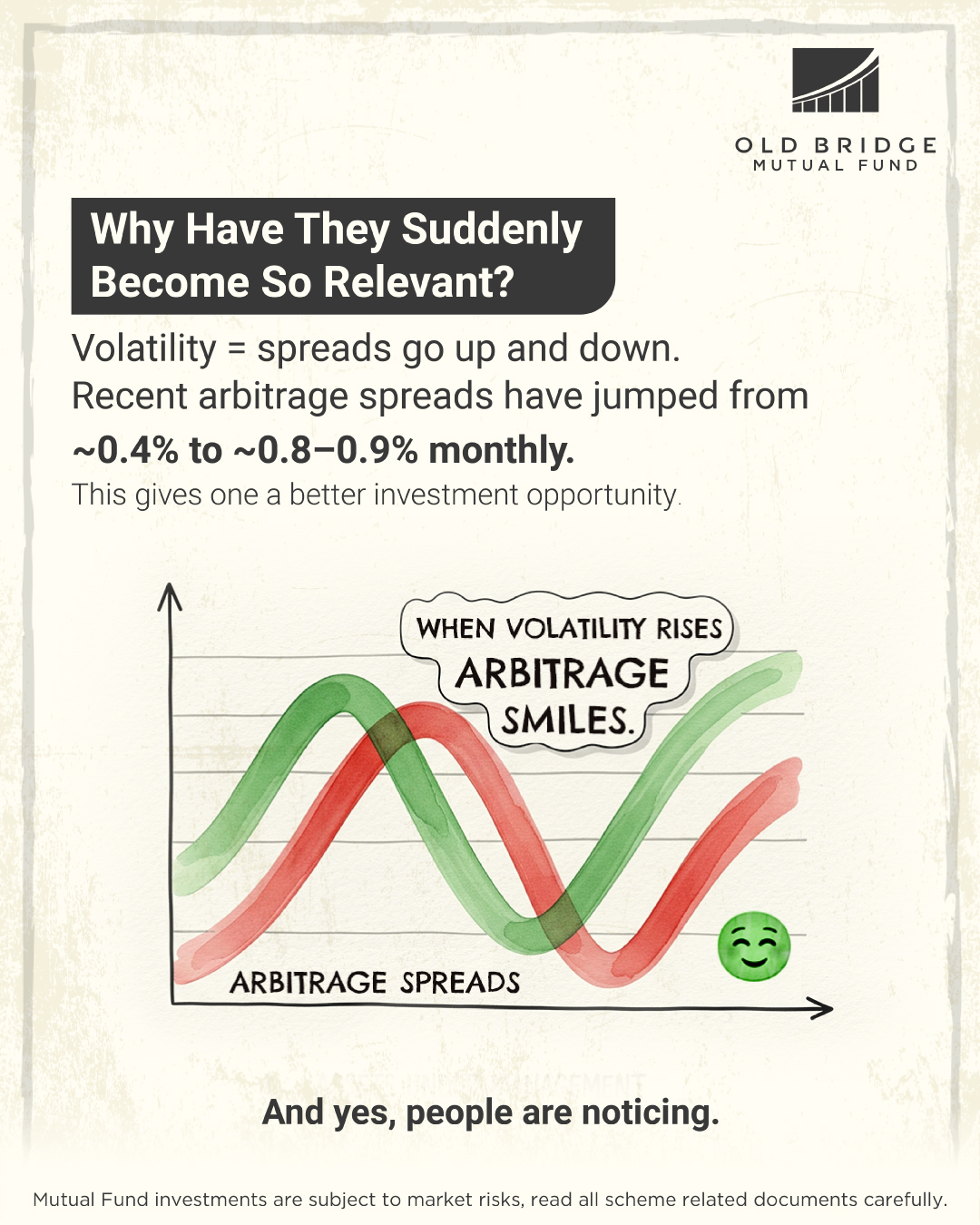

Why It Matters

Just like comparing prices on travel apps can help you save money, Arbitrage Funds aim to make money by spotting similar pricing gaps across markets.

These opportunities tend to increase during periods of volatility, giving the fund more chances to generate returns. And since the strategy is hedged, the fund endeavors to limit the overall market risk.

This makes Arbitrage Funds is preferred by investors who want stability, consistency, and smarter use of their surplus capital.

Why Investors Consider This Fund

- Offers stability in a moving market The fund avoids market timing and focuses on neutral trades that endeavors consistent, low-risk returns.

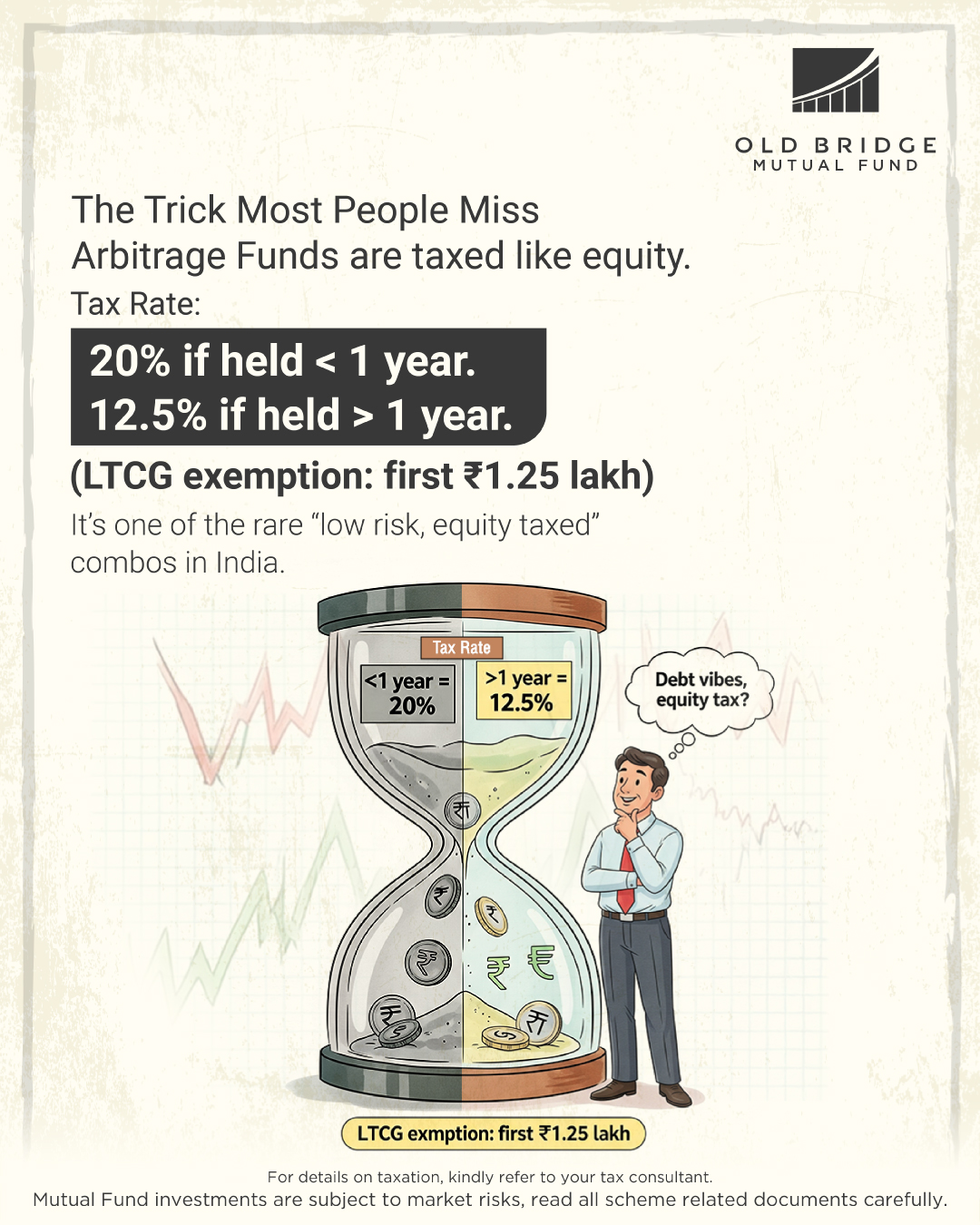

- Better tax treatment with lower riskIf the Arbitrage Fund has a Minimum of 65% equity exposure and is held for over one year, gains are taxed like equity, even though the strategy takes less market risk than most equity funds.

- Works well for short-term parkingA practical option for parking surplus money for 3 to 12 months without locking into traditional fixed-income instruments.

- Volatility becomes an advantage When markets move, more price gaps emerge. The fund aims to capture these efficiently

- More productive than idle cash Instead of letting funds sit in a low-yielding savings account, this strategy helps put that capital to work with minimal risk.

Real-World Use Cases

- A business owner sells property and wants to park ₹50 lakh temporarily. Instead of leaving it idle, they opt for an Arbitrage Fund to earn modest, tax-efficient returns until they reinvest

- A salaried professional receives a large annual bonus but doesn’t need to use it right away. They choose an Arbitrage Fund for short-term allocation, with liquidity and stability in mind.

- A family office is managing a portfolio that includes idle funds not allocated to long-term strategies. Arbitrage Funds offer a way to keep that capital working without taking on unnecessary equity exposure.

The Takeaway

Arbitrage Funds are not about chasing trends or predicting markets. They are about using existing price differences to generate steady returns with limited risk.

Think of them as the deal-hunters of your portfolio. Quiet, calculated, and efficient.

If you are looking for a short-term, low-risk, tax-efficient solution for your surplus capital, this fund may be worth a closer look.

Disclaimer:

The information is for general purposes only and not an investment advice. Readers should seek professional advice before taking any investment related decisions. The document has been prepared on the basis of publicly available data/ information, internally developed data and other sources believed to be reliable.

“An investor education initiative by Old Bridge Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) process. Investors should deal only with Registered Mutual Funds (RMF) details of which can be verified on the SEBI website SEBI|Recognised Intermediaries. For further information on KYC, and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section and contact section available on the website of Old Bridge Mutual Fund.”

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

Women & Investment: Simple Steps, Big Impact: Investing isn’t just about money—it’s about empowerment, security, and building a future with confidence. To help women take charge of their financial journey, we have created a special booklet with simple, relatable insights on savings, investing, and financial planning

Mutual Fund is a mechanism for collecting funds from investors by issuing units to them and then investing funds in securities on behalf of them. Investments in securities are spread across various sectors and industries, thereby minimizing the risk of losing money. The profits or losses are shared by all the investors in proportion to their investment.

The investors of mutual funds are called unit holders. Mutual fund units are issued to the investors in proportion to the quantum of money invested by them. A mutual fund is required to be registered with Securities and Exchange Board of India (SEBI) which regulates securities markets before it can collect funds from the public.

Mutual funds are packed with a bundle of benefits. A few are mentioned below:

- Managed by experts: Mutual Funds are managed by qualified and experienced professionals. Investors may have reasonable capability but to assess a financial instrument, a professional analytical approach is required. Access to research, information, time and methodology also helps them to make sound investment decisions.

- Reduced risk with diversification: Mutual Funds invest in a number of stocks reducing the risk. It provides small investors with an opportunity to invest in a larger basket of securities.

- Time-efficient option: Investors save their time and effort of tracking investments, collecting income and more from various issuers.

- Small investments: It helps investors to invest in small amounts as and when they have surplus funds to invest.

- Transparent dealings: Mutual Funds are well regulated & governed by SEBI (Mutual Funds) Regulations, 1996 thereby ensuring transparency of investments.

- Easy liquidation: Funds like open-ended funds can be redeemed (liquidated) on any business day (when the stock markets and/or banks are open), so investor have easy access to their money.

Mutual funds are pooled investments. A common pool of money invested by many investors is managed by fund investment managers. The fund managers have in-depth knowledge about how the market works and they use their skills and judgment in investing the total amount, which is called corpus. The corpus is invested in securities like shares, debentures and money market instruments. Profit generated through these investments is then distributed amongst investors in proportion to their investments made.

The risk in Mutual Funds investment is mainly refers to the possibility of returns being different from what was originally expected. In other words risk indicates volatility of returns. Generally higher the return higher would be the risk associated with the investment. This relationship of risk and return is central to investing, which all investors should be aware of. Mutual funds are known best for minimizing the risks involved in market investments through its diverse and professional management. Yet, the risks led by price fluctuation, liquidity, credit risks, etc. cannot be avoided. An investor may select schemes prudently depending on his risk taking capability, keep a track of market happenings and take proactive actions if needed.

Investment in Mutual Fund Units involves investment risks such as trading volumes, settlement risk, liquidity risk, default risk including the possible loss of principal.

Equity based funds generally have high risk profile compared to debt funds.

Mutual Funds are among the most transparent collective investment vehicles in India. They are regulated by the capital market regulator Securities and Exchange Board of India (SEBI). SEBI protects the interest of the capital market investors and ensures prudent functioning of mutual funds.

SEBI has mandated elaborate investment guidelines and reporting requirements to ensure that mutual fund investments are under its regulatory purview. It also stipulates the investment of money by the investors and their valuation on an ongoing basis.

Association of Mutual Funds in India (AMFI), a trade body of mutual funds in India also involves itself in devising compliance and best practices guidelines in the industry to ensure professional ethics.

Yes, non-resident Indians can also invest in mutual funds. NRIs will get all the details pertaining to this in the offer documents of the schemes.

Asset Management Company (AMC) is essentially a Mutual Fund company that invests the funds collected by its mutual fund schemes into securities as specified in the investment objective of each particular scheme. They provide the investors with more diversification and investing options than they would have by themselves.

NAV or Net Asset Value is the per unit market value of the mutual fund. It is the price at which investors purchase or sell fund units. It is calculated by dividing the total value of all the assets in a portfolio, minus the liabilities by the total number of units of the scheme. Since market value of underlying holdings changes every day, the NAV of a scheme also varies on a day to day basis. For example, if the market value of securities of a mutual fund scheme is Rs 100 lakhs and the mutual fund has issued 10 lakhs units of Rs. 10 each to the investors, then the NAV per unit of the fund is Rs.10. NAV is required to be disclosed by the mutual funds on daily basis.

NAVs of mutual fund schemes are published on respective mutual funds’ websites as well as AMFI’s website daily - www.amfiindia.com.

NAV (in Rs terms) = Market or Fair Value of Scheme's investments + Current Assets - Current Liabilities and Provision / Number of Units outstanding under Scheme on the Valuation Date

Schemes are defined as per the Maturity Period:

- Open-ended Fund/ Scheme: An open ended fund or scheme is available for subscription and repurchase on a continuous basis and does not have a fixed maturity period. Investors can buy and sell units at Net Asset Value (NAV) related prices which are declared on a daily basis. One of the key features of open-end schemes is liquidity.

- Close-ended Fund/ Scheme: With a stipulated maturity period e.g.

5-7

years, the fund is open for subscription only during a specified period at the

time of

launch of the scheme. It is open for investments at the time of the initial

public

issue and thereafter they can buy or sell the units of the scheme on the stock

exchanges where the units are listed.

Mutual Fund Schemes would be broadly classified in the following groups:

- Equity Schemes

- Debt Schemes

- Hybrid Schemes

- Solution Oriented Schemes

- Other Schemes such as Exchange Traded Funds/ Index Funds

It is a good practice to monitor the performance of the mutual fund schemes one has invested in at fixed intervals. This helps to take timely decisions in case they need to exit from the investment.

The performance of a scheme is reflected in its net asset value (NAV) which is disclosed on daily basis. The mutual funds are also required to publish their performance in the form of halfyearly results which also include their returns/yields over a period of time i.e. last six months, 1 year, 3 years, 5 years and since inception of schemes. Investors can also look into other details like percentage of expenses of total assets as these have an affect on the yield and other useful information in the same half-yearly format. The mutual funds are also required to send annual report or abridged annual report to the unitholders at the end of the year.

Investors can monitor their investments with:

- A fund fact sheet: It is like a report card that indicates the health of the scheme. Published by a fund house, it enlists details of each of the schemes managed by the fund house. It usually consists of details of the portfolio which depicts the investments made by the scheme, performance of the scheme and size and investment details of the scheme.

- Analysts’ reports: Investors can also get the performance of mutual fund scheme in the analysts’ reports in the media.

- Websites: There are a number of websites that offer in-depth analysis of mutual fund schemes in terms of comparable schemes, the benchmark index and average performance of all schemes in the category the scheme falls in.

If investors are investing in schemes like ETFs, then they must have a Demat account as these schemes are compulsorily allotted in Demat mode. For allotment in physical mode there is no need for a Demat account. Units of all mutual funds schemes can be allotted in both the modes i.e. Physical as well as in Demat. Also, the depositories have allowed the DPs to facilitate holding of mutual funds in Demat account.

In a Direct Plan a mutual fund scheme allows investors to invest in it by directly i.e. without involving or routing the investment through any distributor/agent.

The option of investing in a scheme through direct plan is mandatory by the SEBI Circular no. CIR/IMD/DF/21/2012, dated September 13, 2012.

Yes. All categories and types of investors can invest in Direct Plans as per the needs of the portfolio.

What is a Regular Plan ?Investor may choose to invest in mutual funds with the help of a Mutual Fund distributor/agent in what is termed as a ‘Regular Plan’

The most important difference between a Regular Plan and Direct Plan is the involvement of a broker and brokerage in the transaction. Direct Plan has lower expense ratio than the Regular Plan, as there is no distributor/agent involved, and hence there is saving in terms of distribution cost/commissions paid out to the distributor/agent, which is added back to the returns of the scheme. Hence, a Direct Plan has a separate NAV, which is higher than the “Regular” Plan’s NAV.

A New Fund Offer or NFO is either an offer for a new mutual fund scheme being launched by a company or the launch of additional units of existing close-ended funds that are available for investing.

‘IDCW’ is abbreviation of ‘Income Distribution cum Capital Withdrawal’. SEBI changed the term “Dividend Option” in mutual funds to “IDCW” in April 2021. The objective behind this was to use the correct nomenclature. Many investors misunderstood dividends declared by mutual funds as a bonus over and above the returns delivered by a scheme. This was quite misleading and could affect an investor's investment plan. Therefore, SEBI decided to rename the Dividend plan to IDCW to explain the differences clearly, avoid misconceptions, and promote transparency.

The dividend declared by a mutual fund is, in fact, the income arising from the investors’ invested capital. This is why the NAV of the scheme falls to the extent of the dividend paid by the scheme under the IDCW plan. The resulting reduced NAV after the payment of the dividend is called ex-dividend NAV.

It is important to note that IDCW declared by mutual fund schemes are subject to distributable surplus, which is a function of market conditions and the performance of the scheme. Distribution of scheme profit by way of IDCW is declared at the discretion of the fund manager. IDCW may include dividends paid by the underlying stocks and capital gains made by selling such stocks from the scheme’s portfolio.

The growth option declares no dividend, which means there are no re-investment options either. The dividend distribution tax is also not applicable on these funds. This is why the NAV would capture the full value of portfolio gains in the growth option.

SIPs help in investing a fixed amount at specified periods in various mutual funds scheme. It is a great way to bring discipline in investment habits and helps investors plan for their future. 3 prime benefits of investing in SIP:

- Disciplined investment: SIPs ensures that investments are done at a pre-determined schedule, regularly

- Smaller investments: SIP lets investors invest in small amounts. Thus, investments are not burdensome yet rewarding in the long run with its returns.

- Average investment cost: In an equity mutual fund, investors can earn more units when prices are falling and fewer units when the prices are rising, which helps them in averaging the investment cost.

SWP is an investment that allows investors to withdraw money from their existing mutual fund account at predetermined intervals. If the investor wants a steady stream of cash inflows from the investments, opting for SWP serves is the best choice.

To balance the risk factor involved in investing lump sum of investment money in equity fund or debt fund, Systematic Transfer Plan is the best option. STP could be seen as a combination of SIP and SWP, wherein the investor transfers a fixed amount of money from one scheme to another, usually between debt fund and equity fund. The investor here can avoid the risk of investing all of capital in equity mutual fund as this investment could be risky subject to markets’ volatility and its relative impact on returns in equity fund. On the other hand, investment only in debt fund will create moderate income. An STP thus helps to strike a balance between risk and return. It helps average the risk and returns involved in investments. If investors already have investment in equity scheme but want to exit, they can avoid the risk of a sharp fall in equity markets on the date of lump sum withdrawal by using STP. Investing in STP will help in gradually pulling out money from equity funds.

STP invests a specific amount at specific intervals in an equity fund. This helps in averaging the cost of equity investment as more units are received when prices are falling and lesser units are received when prices are rising. STP rebalances the portfolio by reallocating investments from debt to equity or vice versa. If investment in debt increases, the money can be reallocated to equity funds through systematic transfer plan and if investment in equity goes up, money can be conveniently switched from equity to debt fund.

There are two types of STPs:

- Fixed STPs: A fixed sum will be transferred to the selected transferee scheme under various plans/options.

- Capital Appreciation STP: The amount of capital that is appreciated gets transferred to the selected transferee scheme under various plans/options. The original lump sum amount invested in the Transferor scheme remains unchanged.

The option offered to investors to shift their investment from one scheme to another within that fund is called a Switch. The process of switching involves a fee. Switching is a good way for the investors to allocate their investment among the schemes in order to match their altering investment needs, risk profiles or changing circumstances during their lifetime.

KYC is an acronym for "Know Your Customer" and is a term used for Customer Identification Process as a part of Account Opening process with any financial entity. KYC establishes an investor’s identity & address through relevant supporting documents such as prescribed photo id (e.g., PAN card) and address proof and In-Person Verification (IPV). KYC compliance is mandatory under the Prevention of Money Laundering Act, 2002 and Rules framed there under, read with the SEBI Master Circular on Anti Money Laundering (AML) Standards/ Combating the Financing of Terrorism (CFT) /Obligations of Securities Market Intermediaries.

Know Your Customer (KYC) is a process of to identify and verify the identity of a company’s clients. In order of make the process uniform and to avoid duplication in the process across the intermediaries in the securities market; SEBI vide Circular No. MIRSD/SE/Cir-21/2011 dated October 5, 2011, SEBI (KYC Registration Agency) Regulations, 2011 and Circular No. MIRSD/ Cir-26/ 2011 dated December 23, 2011 introduced the concept of KYC Registration Agency (KRA) effective January 01, 2012.

Fill the new KYC application form:A standard Account Opening form (AOF) is generally divided in 2 parts:

- Part I contains the basic and uniform KYC details of the investor as prescribed by the Central KYC registry (Uniform KYC) to be used by all registered financial intermediaries and

- Part II additional KYC information as may be sought separately by the financial intermediary such as a mutual fund, stock broker, depository participant opening the investor’s account (Additional KYC).

The duly completed KYC form along with supporting documents such as proof of identity and proof of address and the Account Opening Form may be submitted at any of the Points of Service (POS)/Investor Service Centre (ISC) of any mutual fund. The In Person Verification (IPV) also needs to be completed and certified by an uthorized person on the KYC form itself. Your distributor/financial advisor will be able to assist you in this regard.

In case of mutual funds, the IPV can be performed by an authorised official of a mutual fund, AMFI registered Distributor or an authorised officer of a Scheduled Commercial Bank.

If PAN and KYC details of the investors are already updated in the company’s records then they don’t need to repeat the formalities. In case any further details are required as per new regulations, the investor will be notified. They can then submit the details at any of the mentioned Service Centers. New investors who have not completed their KYC process need to complete formalities as per SEBI’s KRA regulations.

When an investor redeems or transfers his units between schemes of mutual fund, a non refundable fee is deducted from the NAV at the time of such transaction by the Asset Management Company. This fee is known as exit load.

When investors sell units of open-ended scheme, the redemption price at that time is called redemption price. The redemption price is same as NAV, unless the fund levies an exit load in which case the redemption price will be lower than NAV.

The price at which a close-ended scheme repurchases its units is called repurchase price. Repurchase can be at NAV as well as have an exit load.

| Date Of IAP | 21-11-2025 |

| Address of IAP | Khushii Foundation 162A, 1st Floor, Azrabai Chawl, Sant Kakkaya Marg, Shastri Nagar, Dharavi Koliwada, Mumbai 400017 |

| City/Location of IAP | Mumbai |

| Contact Person | Sajith Nair |

| Contact details | 9324174797 |

| Time | 1:00 PM |

| Status | Conducted |

| Format of the IAP | On-ground Event (Closed) |

| Target Audience | Women |

| Date Of IAP | 01-11-2025 |

| Address of IAP | Antraweb Technologies Pvt. Ltd. 1st Floor, B-Wing, Steel House Off Mahakali Caves Road Near Paper Box Road, Andheri East Mumbai Maharashtra 400093 |

| City/Location of IAP | Mumbai |

| Contact Person | Sajith Nair |

| Contact details | 9324174797 |

| Time | 3:00 PM |

| Status | Conducted |

| Date Of IAP | 30-07-2025 |

| Address of IAP | Vedanta Foundation Opposite Udyog Vihar Jai Mata Di Nagar Opp. Vitthalwadi Rly Stn Kalyan Thane Maharashtra 421003. On-ground Event - Women IAP (Closed Group) |

| City/Location of IAP | Thane |

| Contact Person | Sajith Nair |

| Contact details | 9324174797 |

| Time | 1:00 PM |

| Status | Conducted |